Building a Responsible Relationship with Debt and Credit

Debt and credit have become the backbone of our modern economy, allowing us to purchase big-ticket items and invest in our future. However, when not managed responsibly, it can quickly become a burden, negatively impacting our financial security and well-being. It’s essential to understand the importance of building a responsible relationship with debt and credit to avoid financial hardships. In this article, we’ll dive deeper into how to achieve this and why it’s crucial for your financial success.

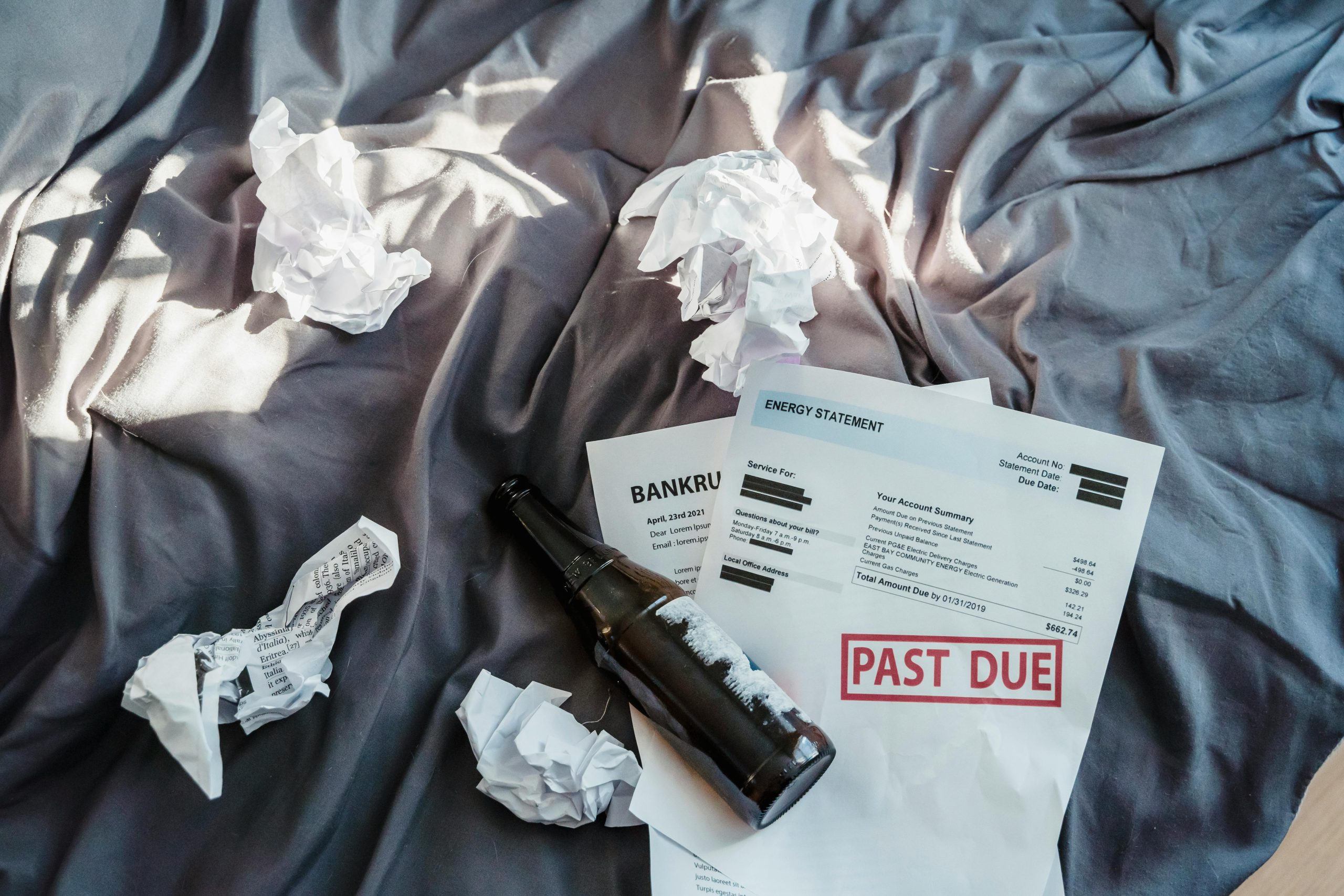

The Dangers of Irresponsible Debt and Credit Usage

First and foremost, it’s crucial to recognize the potential dangers of mismanaging your debt and credit. When used irresponsibly, they can quickly spiral out of control, leaving you in a cycle of constant payments, high-interest rates, and a decrease in your credit score. This can lead to difficulties in obtaining loans in the future and negatively impact your ability to make significant financial decisions.

Moreover, irresponsible debt and credit usage can also have a considerable impact on your mental and emotional well-being. Constantly worrying about debt and struggling to make ends meet can cause stress, anxiety, and even depression. It can also put a strain on personal relationships and negatively affect your overall quality of life.

Building a Responsible Relationship with Debt

Now that we understand the dangers of irresponsible debt and credit usage let’s dive into how to build a responsible relationship with debt. The first step is to acknowledge your current debt and create a plan to pay it off gradually. This could mean increasing your monthly payments, exploring debt consolidation options, or seeking help from a financial advisor.

Additionally, it’s crucial to understand the difference between good debt and bad debt. Good debt refers to loans or credit used to purchase assets that will appreciate in value or generate income, such as student loans or a mortgage. On the other hand, bad debt refers to high-interest debt used for non-essential purchases such as credit card debt. It’s essential to prioritize paying off bad debt first to avoid accumulating more interest and hurting your credit score.

Another key aspect of building a responsible relationship with debt is budgeting. Creating and sticking to a budget allows you to have a clear understanding of your finances and make informed decisions when it comes to spending and saving. It also helps to avoid overspending and accumulating more debt than you can handle.

The Importance of Credit Management

In addition to managing your debt responsibly, it’s also crucial to have a good understanding of credit management. Credit scores play a significant role in financial decisions, such as obtaining a loan or applying for a credit card. A high credit score can also lead to better interest rates and more favorable terms.

To maintain a good credit score, it’s essential to pay your bills on time, keep your credit card balances low, and avoid opening too many new lines of credit. It’s also crucial to regularly check your credit report for any errors or fraudulent activity that could negatively impact your score.

The Benefits of a Responsible Relationship with Debt and Credit

Building a responsible relationship with debt and credit not only helps you avoid financial hardships, but it also has many other benefits. By managing your finances effectively, you can improve your credit score, lower your interest rates, and ultimately save money in the long run. It also gives you peace of mind and improves your overall quality of life.

In addition, a responsible relationship with debt and credit allows you to plan for your future and achieve your financial goals. With lower interest rates and a healthier credit score, you can have better access to loans and make significant investments, such as purchasing a home or starting a business.

Conclusion

In conclusion, it’s crucial to build a responsible relationship with debt and credit to avoid the potential dangers of irresponsible usage. By acknowledging your current debt, creating a budget, and understanding credit management, you can take control of your finances and achieve financial stability. Remember, responsible debt and credit usage not only improves your current financial situation but also sets the foundation for a brighter financial future.